Published April 2021, most recently updated August 2021

What is the Child Tax Credit?

The Child Tax Credit was first enacted in 1997 and has consistently helped families afford the everyday expenses of raising children. Until now, this has been done through a tax credit that some parents and caregivers could claim when they filed their taxes. Taxpayers who are eligible for the benefit are able to subtract its value from the total amount of taxes they owe.

The American Rescue Plan, signed into law on March 11, 2021, makes the CTC available to more children and their families. It extends eligibility to the 23 million children—disproportionately Black and Latinx children—who previously did not qualify because their families make too little. It corrects a long-standing issue with the policy: reaching the kids who need help the most and doing right by our children. This expansion may significantly reduce child poverty and racial disparities this year, and in the long-term, it is likely to increase income security, provide flexibility and freedom to families, and invest in a brighter future for our children.

What do I have to do to get the Child Tax Credit?

Families who filed federal income taxes in 2020 or 2019 or signed up for the stimulus checks using the IRS’s non-filer portal last year will not need to take any additional steps to receive the benefit. On July 15, nearly 60 million children received the CTC benefit automatically, either via direct deposit to their bank accounts or in the form of a paper check.

If you did not file your taxes in the last two years, or sign up to get a stimulus check last year using the Non-Filer sign-up portal, you still have time to receive the CTC, but you will need to take additional action. You can sign-up using the new CTC Non-Filer Sign-up Tool to get your CTC monthly payment and your stimulus check. Families who aren’t sure if they need to take additional action to sign up for the CTC can consult this helpful flow chart from the Consumer Financial Protection Bureau. Or you can use the CTC Eligibility Assistant Tool to check if you are eligible for the CTC.

How will I receive the Child Tax Credit payment?

If the IRS already has your bank account information on file, you will receive the CTC advanced monthly payments through direct deposit, as you would receive a tax refund or have received recent stimulus payments. If you do not have a bank account or have not shared your account information with the IRS, a paper check will be mailed to your address on file. For those who have new bank accounts or do not have a bank account on file with the IRS, you can use the CTC Update Portal to update your bank account information. It will take a few weeks for the IRS to update your bank account information. For example, updates made by August 2nd will apply to the August 13th payment and for all subsequent months. For more information on how to update bank account information, click here.

If you do not have a bank account, here are some resources that could be helpful: visit the FDIC website or the National Credit Union Administration using their Credit Union Locator Tool for information on where to find a bank or credit union that will allow you to open an account online and how to choose the right account for you.

When will I get the monthly CTC payment?

Families began to receive monthly payments on July 15, 2021. Subsequent monthly payments will be issued on or around the 15th of every month. According to the IRS the monthly payments schedule for the rest of the year will be: July 15, Aug. 13, Sept. 15, Oct. 15, Nov. 15 and Dec. 15.

To receive the second half of the advanced CTC, you will have to file a 2021 tax return in 2022 to get the remainder as a lump sum on your tax return.

How much money will I get?

The simple answer is that it depends on your income, how many children you have, and their ages.

The newly expanded CTC is available to families making $75,000 per year or less for single filers, $112,500 per year for heads of household, and $150,000 for married couples filing jointly. You will receive $3,600 per child under six years old and $3,000 per child age six to 17—with monthly payments that started on July 15th. Meaning, families will receive $300 per child for children under six, and $250 per child between six and 17. If you sign up for advance payments after July 15, you may receive larger monthly payments through the end of the year.

So, for example, if you have one child, aged seven, you will receive $3,000 over the course of a year, or $250 per month. If you have two children, aged four and seven, you will receive $6,600 over the course of the year, or $550 per month ($6,600 divided by 12 months).

How do I qualify?

Families in the U.S. and territories qualify for the newly expanded CTC. Joint filers making up to $150,000, single head of households making up to $112,500, and other single filers making up to $75,000 qualify for the full advanced monthly payment of the CTC.

The monthly payment begins to reduce by $50 for every additional $1,000 of income earned. Higher-income families who previously qualified are still eligible for the $2,000 per child benefit for individuals making up to $200,000 and joint filers making up to $400,000. Meaning, they will not receive less than what they previously did.

What information do I need to use the CTC Non-Filer Sign-up Tool?

You can use the tool now IF:

- You did not file taxes in 2019 or 2020 and don’t plan to for this year.

- You did not claim the 3rd stimulus check.

- Your 2020 income is below $12,400 ($24,800 for a married couple or $18,650 for head of household).

What you need for the tool:

- Your full name, date of birth, and Social Security Number (or tax identification number)

- Your children’s full name, date of birth, and Social Security Number

- A reliable mailing address

- An e-mail address

- Your bank account information (if you want to receive your payment by direct deposit)

NOTE: The CTC Non-Filer Sign-Up Tool will determine your eligibility based on the information you provide.

What if I want to opt-out of receiving the monthly CTC? What should I do?

The IRS has also created a CTC Update Portal that families can use to “opt-out” of the monthly payment, if they would prefer to have the cash benefit in one lump sum during tax time.

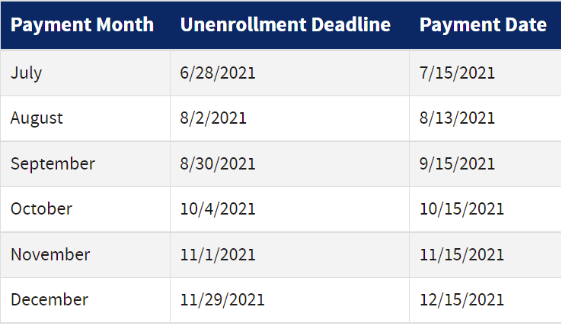

If you wish to opt-out or unenroll from the advanced monthly payments, you must do so three days before the first Thursday of the month. It takes about one week for the IRS to process your unenrollment request. If you unenroll once, you will not need to do it again. Here is a helpful schedule outlined by the IRS.

*If you want to re-enroll to receive the monthly payments, you can do so starting in late September. Check this IRS FAQ for more helpful tips on unenrollment.

How do I check if I’m eligible for the CTC?

Use the IRS CTC eligibility assistant tool to check if you are eligible for advance payments of the Child Tax Credit. The tool will take you through a series of questions, but it will not ask you for sensitive information, like your name, Social Security Number (SSN), address, or bank account information, and none of the information is stored or recorded.

Can my advance payments be reduced if I owe child support payments, back taxes, or Federal or state debt?

No. CTC payments are not subject to intercept. Depending on your state, however, non-federal debtors may be able to garnish advanced CTC payments because the American Rescue Plan Act (ARPA), which established the monthly CTC, did not protect the monthly payments from bank account garnishments by debt collectors, banks, credit unions, or other private debt collectors.

The Children’s Defense Fund is working hard to ensure that the next legislative package includes a fix so the CTC is exempt from garnishment entirely.

What if I already filed taxes for 2020, but I just had a baby or adopted a child. Will I be able to claim the advanced monthly CTC?

Yes, you will be able to update your information to claim your child this year and receive the monthly payment. The IRS CTC Update Portal will allow you to update information about your dependents late this summer, and then you can start getting the advance CTC payments for your child. Even if your child is born or adopted after July 15th, you can still get the advance Child Tax Credit in 2021.

What if I’ve moved and want to update my home address?

You will be able to update your home address. In August, the IRS CTC Update Portal will allow families to update their home address. Check back in August and click here.

What if I don’t have a current home address or I’m moving between homes?

If you don’t have a current home address, you can still file taxes. If you are experiencing homelessness, shelters or other service providers may allow you to use their address for tax purposes. If you are not staying in a shelter, cannot find a service provider nearby, or are otherwise lacking a permanent address, you can also use a relative’s or friend’s address. For more information, here is a helpful resource.

What if I’m a minor and I want to get the CTC. Can I?

Unfortunately, it is not that easy. The rule is that you can’t claim anyone as a dependent if someone has claimed you as a dependent (and had the right to) or if someone could claim you. This includes both if another person could claim you as a Qualifying Child or as a Qualifying Relative dependent.

What exactly are the current qualifying child rules? How do I claim my child?

“Qualifying child” means that you have a child who meets the requirements for certain tax benefits like the CTC. This child must also fulfill the following criteria:

- The Relationship Test: A taxpayer may claim the credit only if they are the child’s parent, grandparent, sibling, aunt, or uncle (or a similarly close step-relative or relative by marriage).

- The Residency Test: A taxpayer may claim the credit only if they reside with the child for at least half of the year (six months) in which the credit is claimed.

- The child is a U.S. citizen, U.S. national, or U.S. resident alien.

While time lived together does not have to be continuous, the intent is that the primary parent or caregiver will receive the cash benefit, because the child has spent over 50 percent of the time with that parent or caregiver. There are some exceptions to this, including temporary absence by you or your child for school, vacation, business, medical care, military service, or detention in a juvenile facility. The IRS also has some exceptions for children of divorced or separated parents and children who have been kidnapped.

- The child does not provide more than one-half of his or her own support during 2021.

- The child does not file a joint return with the individual’s spouse for tax year 2021 or files it only to claim a refund of withheld income tax or estimated tax paid.

The Children’s Defense Fund is working hard to improve these qualifying child rules to better respond to real families’ lives and to follow the child as they move around. To read our proposal on this, click here.

What if my child turns 18 this year? Will they qualify?

No, unfortunately. For the newly expanded CTC, a qualifying child must not turn 18 before January 1, 2022. The highest qualifying age is 17 years.

Do I have to be employed to receive the expanded CTC?

No, you do not have to be employed to receive this newly expanded CTC. Under the ARP, the cash benefit is available to families who have no income. This a change from prior law, which required families to make at least $2,500 to qualify and over $30,000 to get the full benefit of the CTC.

What does an advanced monthly payment mean?

Unless you opt out of monthly payments, your family will receive half of your CTC benefit as an “advance” on your 2021 refund. Families will receive half of the cash benefit to which they are entitled for the year in the form of monthly payments that will run from July through December 2021. You will receive the other half of the payments with your 2021 tax refund when you file your taxes in 2022. Monthly payments, as opposed to a lump sum at tax time, will help families better meet their daily and monthly living expenses.

Can the benefit be split between multiple parents, caregivers, or divorced parents? What if my child has split custody?

While there are exceptions for children of divorced or separated parents, it is very difficult for the IRS to split benefits, because the laws state that each dependent can only be claimed by one taxpayer, meaning two parents cannot each claim the child and receive a payment for the same child. The IRS is basing the 2021 advanced Child Tax Credit payments on the most recently filed tax return (either 2019 or 2020), so the advanced monthly CTC will go to the most recent parent to claim the child. That parent should have received an IRS letter in early June notifying them of this. The IRS CTC Update Portal enables the taxpayer to opt out of the advanced payment if they wish to do so.

If you have any difficulty using the IRS CTC Update Portal, you may also call a designated toll free number for assistance in opting out of the payments: 1-800-906-4184.

It is unclear at this time whether the parent who agrees to opt out of the advance payments could also redirect the monthly payments to the other parent, or whether that parent can only claim the full CTC on the next tax return. This is an area that is likely to be updated by the IRS and we will make sure to provide more info on this page as it becomes available.

What if the IRS sends me a payment that is actually more than I’m supposed to get. Will they make me pay it back? Will I owe any money when I file my taxes next year?

Possibly, but it depends.

Because the IRS is paying out the CTC out on an advanced basis, there is a (quite small) possibility that the IRS could pay someone too much if their family circumstances change from year to year, such as:

- A child moves out of the house (and therefore does not live with the caregiver for the requisite 6 months)

- Income increases

- Tax filing status changes

Families with lower incomes are protected from having to re-pay the benefit by a safe harbor provision in the American Rescue Plan that kicks in if the IRS issues a payment for a child who is no longer living in the household or otherwise no longer qualifies for the CTC. These protections are in place for families with incomes below $40,000 for single filers, $50,000 for head-of-household filers, and $60,000 for joint filers and phase out for families with incomes above these thresholds.

Families protected by the safe harbor provision will not have to pay back overpayments up to $2,000 that arise from the IRS overestimating the number of eligible children in their household. Families earning more will be required to pay back some or all of the overpayment from the IRS. In the event that the IRS overpays the cash benefit arising from changes in other life circumstances, like changes in your income or marital status, families will be required to pay back the full amount of the overpayment regardless of income. If you anticipate your family income in 2021 to be significantly higher than your income in 2020 and you expect your 2021 income to be more than $150,000 for joint filers or $112,500 for a head of household filer, you should consider whether opting out of monthly payments is right for you.

Because the IRS is only paying out half of families’ expected CTC on an advanced basis, we do not expect families to owe the IRS money at the end of the year because of income or filing status changes.

Will I continue to get this cash benefit every year?

Not currently. This is a temporary expansion of the CTC that applies only for tax year 2021. The Children’s Defense Fund is fighting hard to ensure that Congress takes additional action and passes legislation that includes a permanent expansion and includes critical improvements so the CTC reaches all children and families.

What does full refundability mean?

Full refundability means that families with low incomes or no income at all are eligible for the full value of the CTC. Under previous law, taxpayers could only receive the full CTC if they earned enough to owe substantial federal income tax.

By making the credit fully refundable, the American Rescue Plan expands the reach of the CTC and no longer ties it to work and employment status. CDF has long advocated for this change as a way to ensure that all children benefit from this poverty-fighting tax credit.

Will this benefit impact my eligibility for other benefits or programs?

No, the CTC does not impact your eligibility for other federally-funded benefit programs, such as SNAP, Medicaid, SSI, TANF, or other public benefits. Tax credits do not count against earned income.

What if my child is undocumented and has an Individual Tax Identification Number (ITIN). Will they qualify?

No, children who have ITINs do not qualify for the CTC. Unfortunately, the 2017 Tax Cuts and Jobs Act required that children have Social Security Numbers (SSNs) to be eligible for the CTC for the first time—making an estimated 1 million children ineligible for the credit. Rolling back this Trump-era exclusion of immigrant children is vital to ensure that more children benefit from this public investment.

Do I need a Social Security Number (SSN) to claim the Child Tax Credit?

Children must have a SSN to be eligible for the CTC. Parents do not have to have one, but if you must have an ITIN to claim your eligible children.

For more information about mixed status immigrant families, use this guide created by our partners at CLASP.

Where can I get help filing my taxes or using the CTC Non-Filer Sign-Up Tool?

Families who haven’t filed taxes recently can still get the Child Tax Credit, either by filing their taxes in full or using the CTC Non-Filer Sign-Up Tool. To find out whether you need to take additional action to receive the CTC, you can consult this helpful flow chart from the Consumer Financial Protection Bureau.

Families who need to take additional action to sign up for the CTC can do so using the IRS’s Non-Filer Sign-Up tool, available here. For additional information on how to use this tool to sign up for the CTC, you can consult this step-by-step guide or watch this video walkthrough.

Families who are already set to receive CTC payments automatically can use this IRS tool to update their banking information.

Families with some earned income who may be eligible for the Earned Income Tax Credit (EITC) may prefer to file their taxes normally. These families may be able to take advantage of Volunteer Income Tax Assistance (VITA) and Tax-Aide sites offer free and reliable tax filing services. To find a site, visit the IRS’ site locator tool. Families may also use free options to file online, including MyFreeTaxes.

What if I find out that I do not qualify for the benefit? What happens then?

Unfortunately, this program is not perfect or universal. In addition to making this policy permanent, critical changes are needed to ensure that the money follows the child and that all children benefit from this public investment. We are fighting hard for a true, universal child allowance policy that is flexible, easy to access, follows the child, and regularly and meaningfully increases family income. Learn how to contact your members of Congress to advocate for a true, universal child allowance here.

What else is the Children’s Defense Fund doing to ensure this expansion benefits all children?

Put simply, the expanded CTC is an investment in our nation’s future and an acknowledgment that we as a society have a responsibility to ensure the next generation has the opportunity to fulfill their potential and to succeed.

CDF is working to make critical improvements to the expanded CTC permanent and ensure it benefits all children, particularly immigrant children, children in other public systems, and others who have been historically left behind. As you might have noticed, some information that might help you better understand how the newly expanded CTC will benefit your family is forthcoming. We will be consistently updating this page as soon new information is released to keep families up to date on the most recent, pertinent information, so please continue to use this page as a reference.

To print this guide or download a PDF version, click here.